Fiscal Policy Refers to

Automatic fiscal stabilisers If the economy is growing people will automatically pay more taxes VAT and Income tax and the Government will spend less on unemployment benefits. Fiscal policy refers to government measures utilizing tax revenue and expenditure as a tool to attain economic objectives.

Fiscal Policy Overview Of Budgetary Policy Of The Government

In other words fiscal policy refers to how government collects money through taxes and what it spends money on ie.

. Those decisions have. Congress sets fiscal policy with a lot of input from the executive branch. The Chilean government conducts a rule-based countercyclical fiscal policy accumulating surpluses in sovereign wealth funds during periods of high copper prices and economic growth and allowing deficit spending only during periods of low copper prices and growth.

When the government makes financial decisions it has to consider the effect those decisions will have on businesses consumers foreign markets and other interested entities. C the changes in taxes and transfers that occur as. Spending tools refer to the overall government spending.

By reducing the economys amount. This refers to whether the government is increasing AD or decreasing AD eg. Such policies are framed concerning their impact on the country ie on consumers organizations investors foreign markets etc.

However with inflation at 2-4 it meant workers saw a fall in real wages. This has the potential to slow economic growth if inflation which was caused by a significant increase in aggregate demand and the supply of money is excessive. These tools can be divided into spending tools and revenue tools.

On the other hand revenue tools refer to taxes collected by the government. Fiscal year-end is the completion of a one-year or 12-month accounting period. Discretionary changes in government spending and taxes.

A sustainable fiscal policy is defined as one where the ratio of debt held by the public to GDP the debt-to-GDP ratio is stable or declining over the long term. Fiscal policy refers to changes in tax rates and public spending. Fiscal usually refers to government finance.

Explore the tools within the fiscal policy toolkit such as expansionary and contractionary fiscal. Government makes about spending and collecting taxes and how these policy changes influence the economy. Fiscal policy refers to decisions the US.

Fiscal policy refers to A. In this context it may refer to. Expansionary or tight fiscal policy.

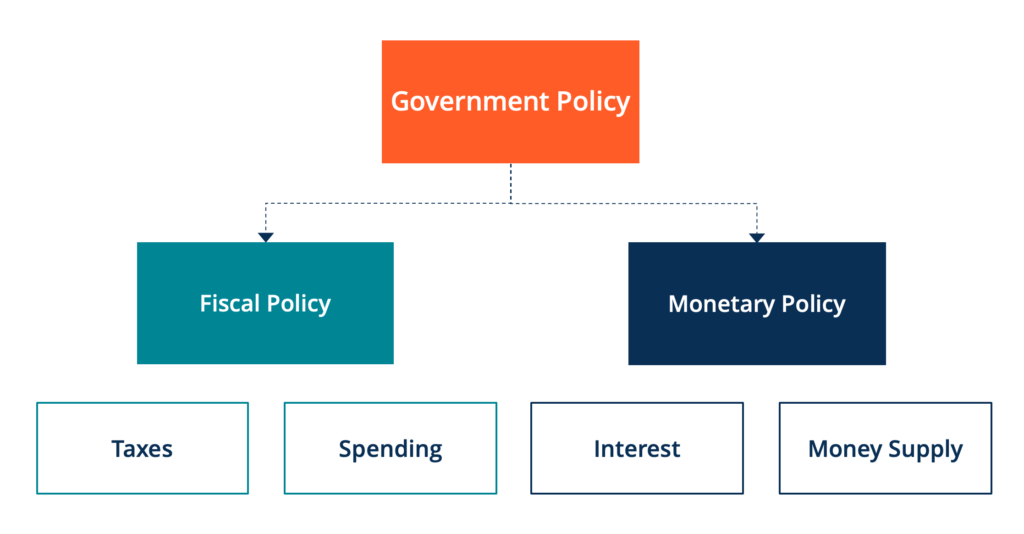

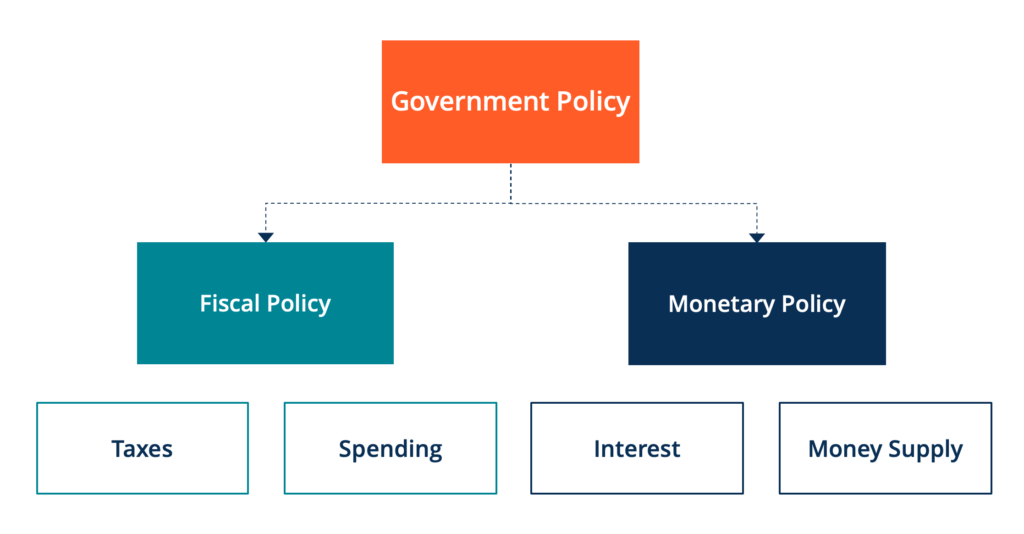

The government possesses two major fiscal tools for influencing the economy. The Austrian manufacturer reported recently a 374 jump in. In periods of nominal wage restraint even a small increase in inflation can lead to a fall in real wages.

For example policymakers manipulate money circulation for increasing employment GDP price stability by using tools such as interest rates reserves. Now expansionary fiscal policy refers to a policy that seeks to grow the economy through fiscal stimulus. Changes in the amount of physical capital in the economy.

Monetary policy involves manipulating interest rates and the. Fiscal implies the budget or how the money will be spent. Expansionary fiscal policy has its pros and cons.

Fiscal policy is the management of government spending and tax policies to influence the economy. Changes in the money supply. It can have a rapid impact if implemented correctly.

The Davidson County manufacturing plant of Egger Wood Products LLC continues to be a major driver in its profit growth. Discretionary changes in government spending and taxes. In May 2010 Chile became a full member of the Organisation for Economic Co.

B intentional changes in taxes and government expenditures made by Congress to stabilize the economy. Monetary refers to the supply of money or the amount there is to spend. 31 is due.

Let us discuss what expansionary monetary policy Monetary Policy Monetary policy refers to the steps taken by a countrys central bank to control the money supply for economic stability. When an economist is using the term discretionary as in discretionary spending they are referring to the A. Contractionary fiscal policy on the other hand is a measure to increase tax rates and decrease government spending.

On its own fiscal policy is the collection and expenditure of revenue by government. Changes in the interest rate. Discretionary fiscal policy refers to A any change in government spending or taxes that destabilizes the economy.

The reason that a companys fiscal year often differs from the calendar year and may not close on Dec. Fiscal policy refers to the budgetary policy of the government which involves the government controlling its level of spending and tax rates within the economy. Fiscal policy use of government expenditure to influence economic development.

It is the other half of monetary policy Monetary Policy Monetary policy refers to the steps taken by a. Considering financial results relative to GDP is a useful indicator of the. Tools of Fiscal Policy.

All the new spending can become a detriment to the economy if it flames inflation. This is a working documentPlease contact Emily Maher and Leo Garcia if you know of any additional information that should be reflected in the database or any errors that should be corrected. What is fiscal policy.

Fiscal policy is a much broader category than monetary policy. Public defence or welfare payments. All taxing and spending decisions made by Congress fall into the category of fiscal policy.

It is the sister strategy to. The Treasury Department released the final rule for the Coronavirus State and Local Fiscal. What is Expansionary Monetary Policy.

Fiscal adjustment a reduction in the government primary budget deficit. The government uses these two tools to influence the economy. Government Spending Tools Capital Expenditure.

It occurs when government deficit spending is lower than usual. US Treasury Final Rule. Terms relating to fiscal policy.

GDP measures the size of the nations economy in terms of the total value of all final goods and services that are produced in a year. For example in the period 2010-17 the UK experience pay restraint especially amongst public sector workers with wages limited by 1 a year.

3 Types Of Fiscal Policy Boycewire

Mosaic Theory Meaning Importance And Example Economics Lessons Financial Analysis Accounting And Finance

What Is Fiscal Policy It Is An Essential Tool At The Disposable Of The Government To Influence A Nation S Economics Lessons Teaching Economics Economics Notes

No comments for "Fiscal Policy Refers to"

Post a Comment